Bruichladdich Whisky Auction Analysis & Price Trends

| Country | Scotland |

| Founded | 1881 |

| Status | Active |

| Website | https://www.bruichladdich.c… |

| Owner | Remy Cointreau |

| Wash stills | 2 |

| Spirit stills | 2 |

| WhiskyBase rating | 86.9 |

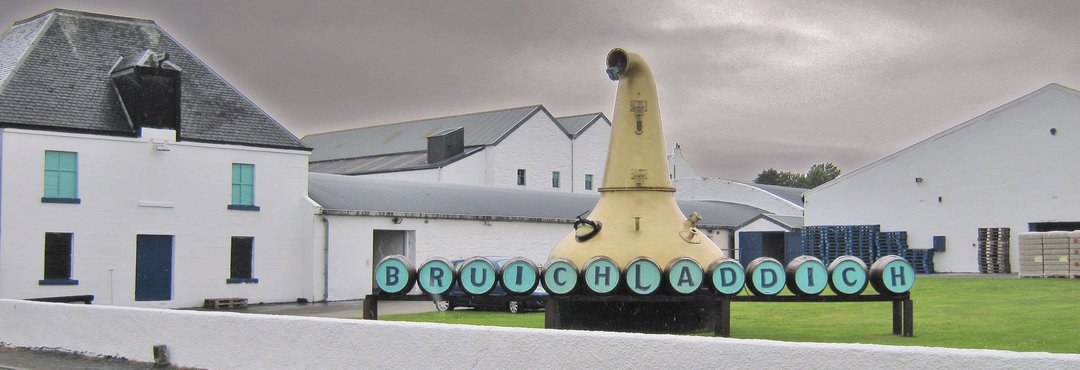

Built in 1881 by the Harvey brothers, Bruichladdich distillery sits opposite the western shore of Loch Indaal on Islay, an island off the west coast of Scotland. The distillery produces three distinct single malts: Bruichladdich (unpeated), Port Charlotte (heavily peated) and Octomore (super heavily peated), along with The Botanist gin.

Among all the interesting Bruichladdich bottles, several ones, highly rated according to WhiskyBase, can be outlined:

- Bruichladdich 40 Year Old (1 of 550, 94+ WB score, DB)

- Bruichladdich 10 Year Old - Samaroli (93+ WB score, CS, DB)

- Port Charlotte 2003 - Sauternes Cask (14 y.o., 91 + WB score, CS, DB)

- Bruichladdich 1970 (35 y.o., 91+ WB score, DB)

- Bruichladdich Legacy Series 1 (36 y.o., 91+ WB score, DB)

- Bruichladdich 1986 (30 y.o., 91+ WB score, DB)

- Bruichladdich DNA (36 y.o, 91+ WB score, DB)

- and more..

Now Jim has made a whisky he calls it his Black Art. It’s mystical, it’s magical – bewitches the heart. Soon every lass on Islay will have to buy a pram. But don’t blame Islay cheese – blame the Bruichladdich dram

-Robin Laing

Explore Bruichladdich Lots From Online Auctions

More than 60588 finished and 378 live Bruichladdich whisky lots in our database. If you are interested in one of the following questions, you have come to the right place:

- Where to buy an collectible or rare Bruichladdich bottle highly rated on Whiskybase at a fair price to add to your collection?

- How and where is the best way to sell whisky at online auction?

- What is the real market price of old or rare Bruichladdich whisky bottle?

Top 10 Expensive Bruichladdich Whiskies Sold at Auctions

Bruichladdich live lots on Catawiki Whisky Auction

| End date | Lot | Auction | Last Bid | Want it? |

|---|---|---|---|---|

| Jul 28 13:10 | Bruichladdich 21 years old - Rinaldi Import - Original bottling - b. mid-late 1980s - 75cl live | Catawiki Whisky Auction | £ 120.0 | Place Bid |

| Jul 28 13:44 | Bruichladdich 1989 23 years old - Black art 1990 04.1 - octomore - b. 2013 - 70cl - 6000 bottles live | Catawiki Whisky Auction | £ 315.0 | Place Bid |

| Jul 28 20:19 | Bruichladdich 10 years old - Original bottling - b. early 1980s - 75cl live | Catawiki Whisky Auction | £ 2.0 | Place Bid |

Top 20 Expensive Bruichladdich Whiskies From Online Retailers

The chart of monthly trade volumes of the Bruichladdich distillery. The chart is in direct proportion to the lot quantity and prices, displaying the liquidity of lots on the secondary market and interest in them. Trading volume growth indicates the drawn attention to distellery

The chart of lot price fluctuation by month of the Bruichladdich distillery. The lot average price chart indicates the growth or fall of the investment attractiveness of whisky over time.

The chart, representing traded lot quantity by month of the Bruichladdich distillery. The chart displays the popularity and seasonal dependence of the quantity of the lots auctioned online.

Frequently Asked Questions

In the FAQ section will find answers to common questions that interest collectors and investors

The value of a Bruichladdich whisky bottle can be influenced by several factors. Below is a detailed breakdown based on key aspects:

- Identification of the Bottle: Initially, it's essential to accurately identify the bottle in question. Familiarity with the specific release, including the release year, alcohol strength, and maturation period, will aid in its valuation.

- Specific Bottle Variation: Numerous releases of Bruichladdich whisky have occurred over the years. The specific release to which a bottle belongs greatly impacts its value. Additionally, the condition of the bottle, the labeling, and the level of fill are crucial factors in determining its worth.

- Sale or Purchase Venue: The platform or venue where you choose to buy or sell the whisky bottle can significantly affect its price. Typically, bottles can be acquired for a lower price at auctions, while retail stores may have higher markups. If selling as a private individual, the most realistic price benchmark is its auction price, although auction commission fees will apply.

Furthermore, by utilizing the Whisky Hunter service, you can independently evaluate the value of your whisky bottle. Our platform offers a thorough analysis and valuable insights to help ascertain the actual market value of your Bruichladdich whisky bottle.

The variation in price for the same bottle across different auctions can be attributed to several factors:

- Diverse Bidder Base: Different auctions attract various types of bidders, each with their own valuation of the bottle, which in turn influences the final price.

- Geographical Differences: The region in which an auction is held can impact demand, especially if certain Bruichladdich releases are scarce or unavailable in specific markets, thus affecting the price.

- Auction Timing: The timing of an auction can influence price due to external factors such as market trends or seasonal demand.

The profitability of buying or selling a Bruichladdich whisky bottle can be impacted by several factors:

- Geographical Location: Your location can affect both buying and selling opportunities, impacting the overall cost and ease of the transaction.

- Shipping Logistics: Considering the logistics and costs tied to shipping the bottle for sale or after purchase is vital for making an informed decision.

- Auction Platforms: Auction platforms often reflect the most accurate market price for buying or selling. However, aspects like commission rates, bidder preferences, and auction timing can result in price variations across platforms.

- Market Trends: In-depth research into the current market conditions and historical data can aid in identifying trends and forecasting potential opportunities for buying or selling Bruichladdich at a favorable price.

Ascertain the most profitable venue for buying or selling a specific bottle requires a careful examination of these factors. Our analysis tools allow you to compare specific bottles across auctions and regions, providing valuable insights. By leveraging these insights and adopting a meticulous, research-driven approach, you can pinpoint opportunities that align with your goals, optimizing profitability and satisfaction in your whisky transactions.

Forecasting the value fluctuation of a Bruichladdich whisky over time is a nuanced and uncertain task. Although past auction prices provide historical insights, they don't necessarily indicate future trends. In the short term, like 1-2 months, recent auction cycles might offer a rough estimate of the bottle's value, but long-term projections are significantly more complex.

The price of a Bruichladdich whisky is swayed by market demand and supply, influenced by numerous factors including rarity, age, branding, economic conditions, and consumer preferences, all of which are unpredictable. Even in the near future, market behavior can be capricious.

Markets often exhibit cyclical tendencies—following a decline, there might be growth. However, this pattern isn't guaranteed, and investment decisions shouldn't solely hinge on this assumption. It's prudent to consult with whisky investment specialists or utilize analytical tools and data available on platforms like ours to decipher the unique traits and trends of the whisky market.

In summation, whisky investment intertwines both art and science, requiring a profound understanding of the product, market dynamics, and one's investment goals. A balanced approach melding patience, research, and a readiness to navigate the intricacies of the whisky realm may foster rewarding investment experiences. Yet, it's vital to remember, like all investments, inherent risks are involved, and past performance doesn't foretell future outcomes.

Investing in a cask of Bruichladdich offers a unique opportunity that could potentially yield profits, albeit with its inherent set of risks and complexities. Here's a detailed examination of various facets to consider:

- Unique Investment Avenue:

Whisky cask investment is a unique venture that can be profitable, yet it necessitates a deep understanding and acceptance of the associated risks.

- Storage Considerations:

Delving into the specifics of cask storage—including costs, conditions, and regulatory compliance—is crucial to ensure optimal maturation conditions.

- Ownership Transfer Intricacies:

Understanding the intricacies involved in the transfer of cask ownership rights, ensuring proper documentation and adherence to legal procedures, is vital to secure your investment.

- Fraud Prevention:

Given the potential for fraud, thorough scrutiny of ownership transfer details and vetting the seller is imperative to mitigate risks.

- Auction Acquisitions:

Acquiring casks at reputable whisky auctions is generally less risky, as auction houses often vet sellers and ensure the legitimacy of the ownership transfer.

- Investment Analysis:

Our platform provides resources to evaluate the viability of investing in a cask of Bruichladdich. With data on over 1,000 casks sold or listed at auctions, you can leverage our platform for a thorough analysis. Refer to this blog article on analyzing whisky cask sales at auctions using our platform.

In summation, a cask investment in Bruichladdich requires a comprehensive understanding of the whisky market, legal procedures, and the specifics of cask ownership and storage. Platforms like ours can offer valuable insights and data to aid in making an informed investment decision.

The collectibility of a Bruichladdich whisky hinges on several factors. Here are some key aspects to ponder:

- Rarity: Limited editions or discontinued bottles often pique collectors' interest.

- Brand Prestige: Renowned brands or producers usually hold a higher esteem in the collector's realm.

- Historical Significance: Bottles linked to notable events or personalities may appreciate in value.

- Condition and Packaging: The bottle's appearance and packaging, including label, capsule, and box, play a significant role in its valuation.

- Market Trends: Prevailing market trends and investor sentiment can influence the collectibility of the whisky.

- Personal Affinity: Your own tastes and the thematic alignment of your collection should steer your decision.

Integrating a bottle of Bruichladdich into your whisky collection is fundamentally a personal endeavor, steered by your interests, budget, and collection strategy. Our platform facilitates a thorough exploration of the collectible whisky market, enabling you to compare options and make an enlightened decision that resonates with your objectives.

- We endeavor to furnish precise and exhaustive data. Utilizing a blend of automated tools and manual verification, our team aggregates information from trustworthy and open sources.

- Though we prioritize accuracy, it's crucial to recognize that errors, albeit rare, may transpire. Our platform facilitates easy cross-referencing with primary sources, which we highly recommend to affirm the data's validity.

- Beyond data, we extend analytical tools to help decipher market trends and evaluate a particular bottle's value, aiding you in making informed decisions.

It's pivotal to note that our platform is an informational resource and should be leveraged alongside professional guidance for investment or purchasing decisions. We furnish all data sans liability and underscore that it does not constitute investment advice. It's prudent to assess risks and seek professional counsel when requisite.